S2N lights

Today we will focus on Meta to take a more comprehensive look. If you don’t have worked now, I am very young. I love to drop them. Meta has increased incredible in a row, which is more than any wonderful companies 7.

I think that before we continue in the spotlight, it has also emptied the extent of this. If we are talking about a natural distribution in the true sense of the word, or 50 % on average up and down, getting 20 consecutive will be one through a million possibilities.

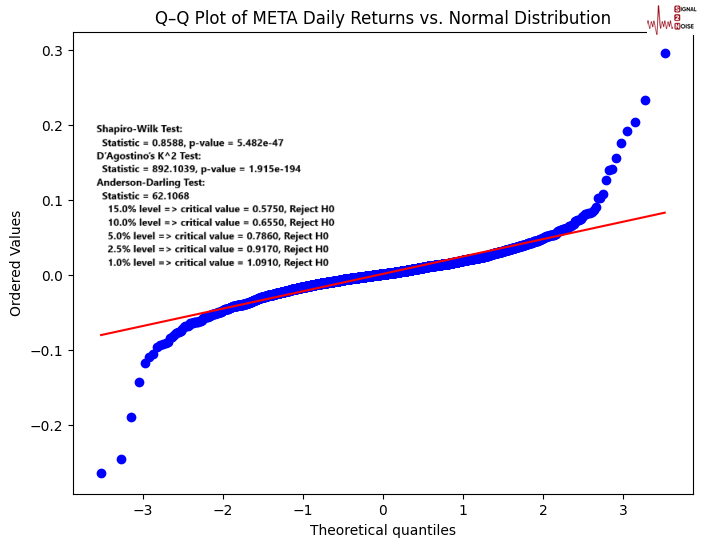

However, anyone who has worked with a financial series will know that it is not normal. Shares I have a memory, at least more than my grandmother at the end. Let’s get out of the eccentric genius. The results of 3 normal life tests have added to the graph. The definition is not normal. Then again, who are these days? I will likely fail all three tests myself.

The bottom line is that Meta has an average of 52.5 % of time. The possibility of getting 20 consecutive days with our abnormal distribution is 1 in 389,000. This was a word to say this is rare.

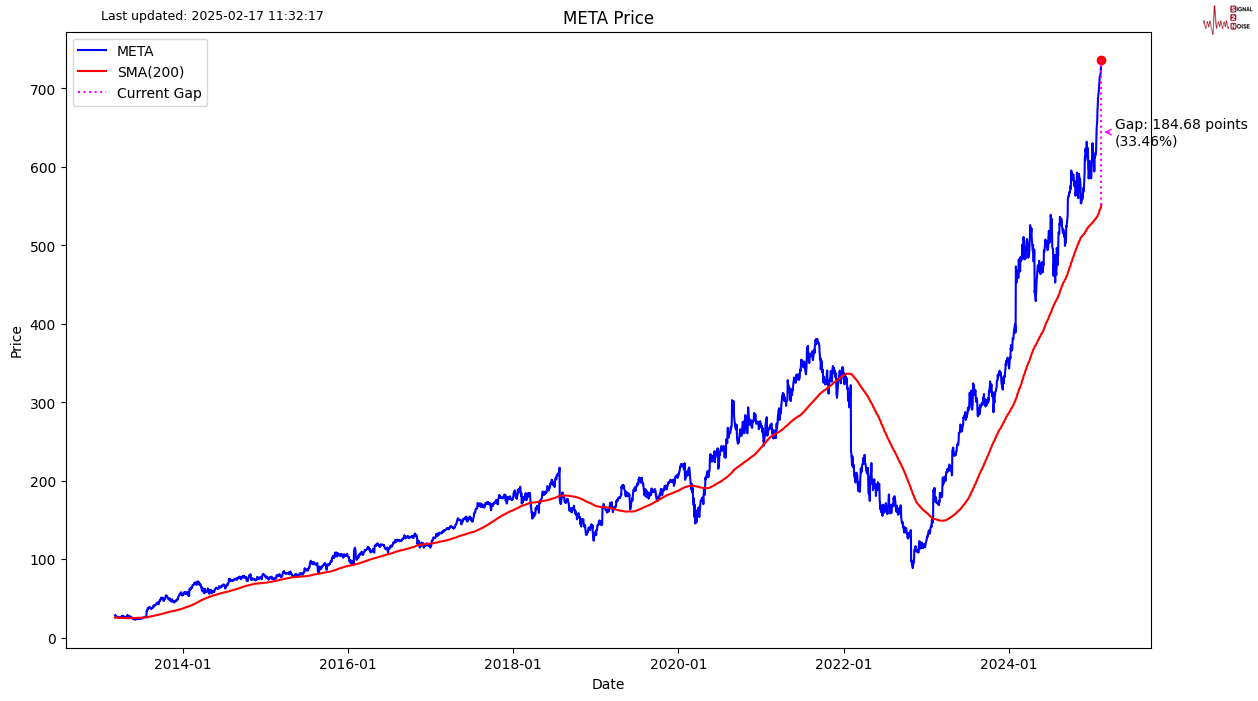

Take a look at the current price distance from the moving average for 200 days. 33 % larger than anything we have seen in the past. A prime gap can be swallowed easily X. Footage launched Eileon.

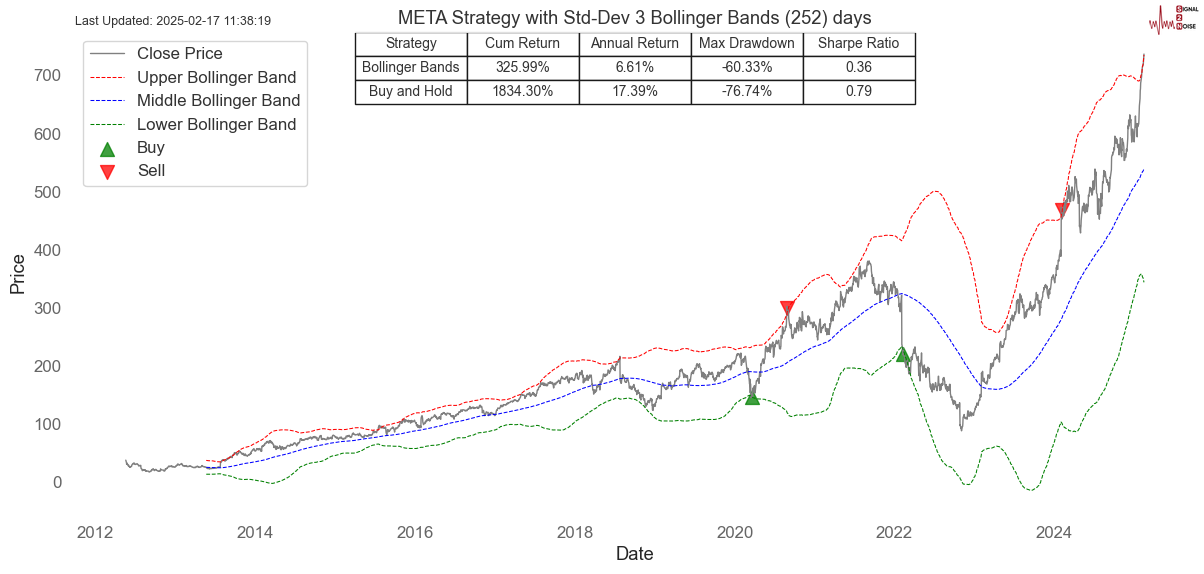

Let’s take another look at how much the Meta stock moves. It is about to reach the upper Bollinger of Devil 3. This happened only twice in the past. I share a strategy below to trade such extreme letters. It is better to be better at all to trade this strategy if you want to earn money and avoid death from boredom waiting for a sign that it is not good as you think.

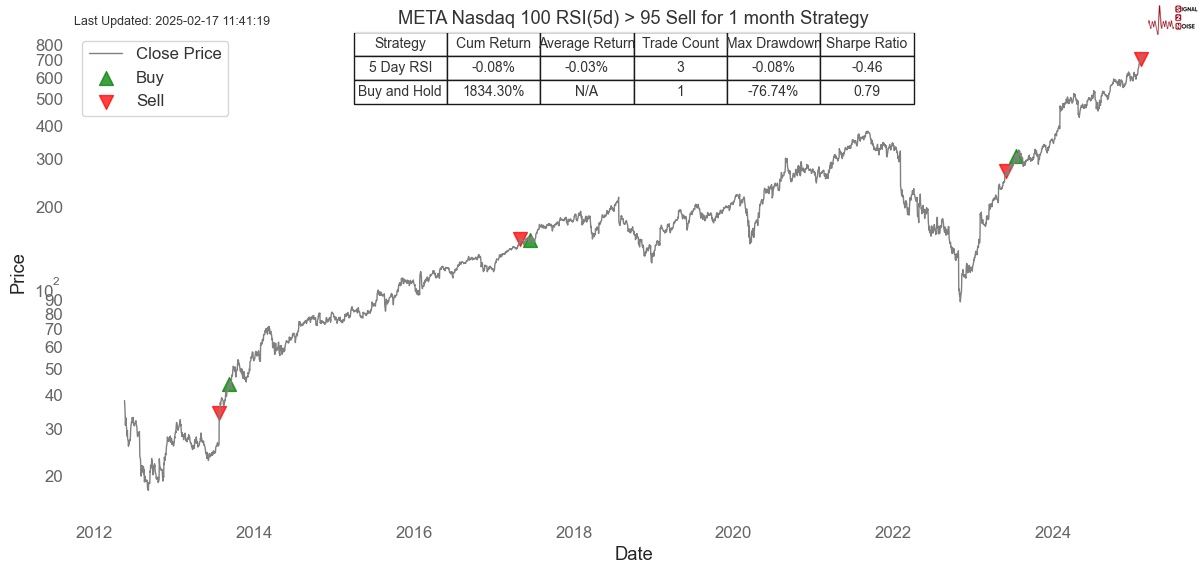

Let’s go a little deeper. This strategy searches for a short -term strategy with the relative power index for 100 days above 95. This only happened 3 times. We got the third sign last week. If you are selling now and hold for a month, you will lose money.

With everything I said, I showed that we are in a very rare position in the peak. Certainly I will look at the short Meta for a few days with this excessive preparation in the peak. The possibility of more days in a row is to get greatly unlikely, for short benefit. Trading in my career. This is not a financial advice.

S2N notes

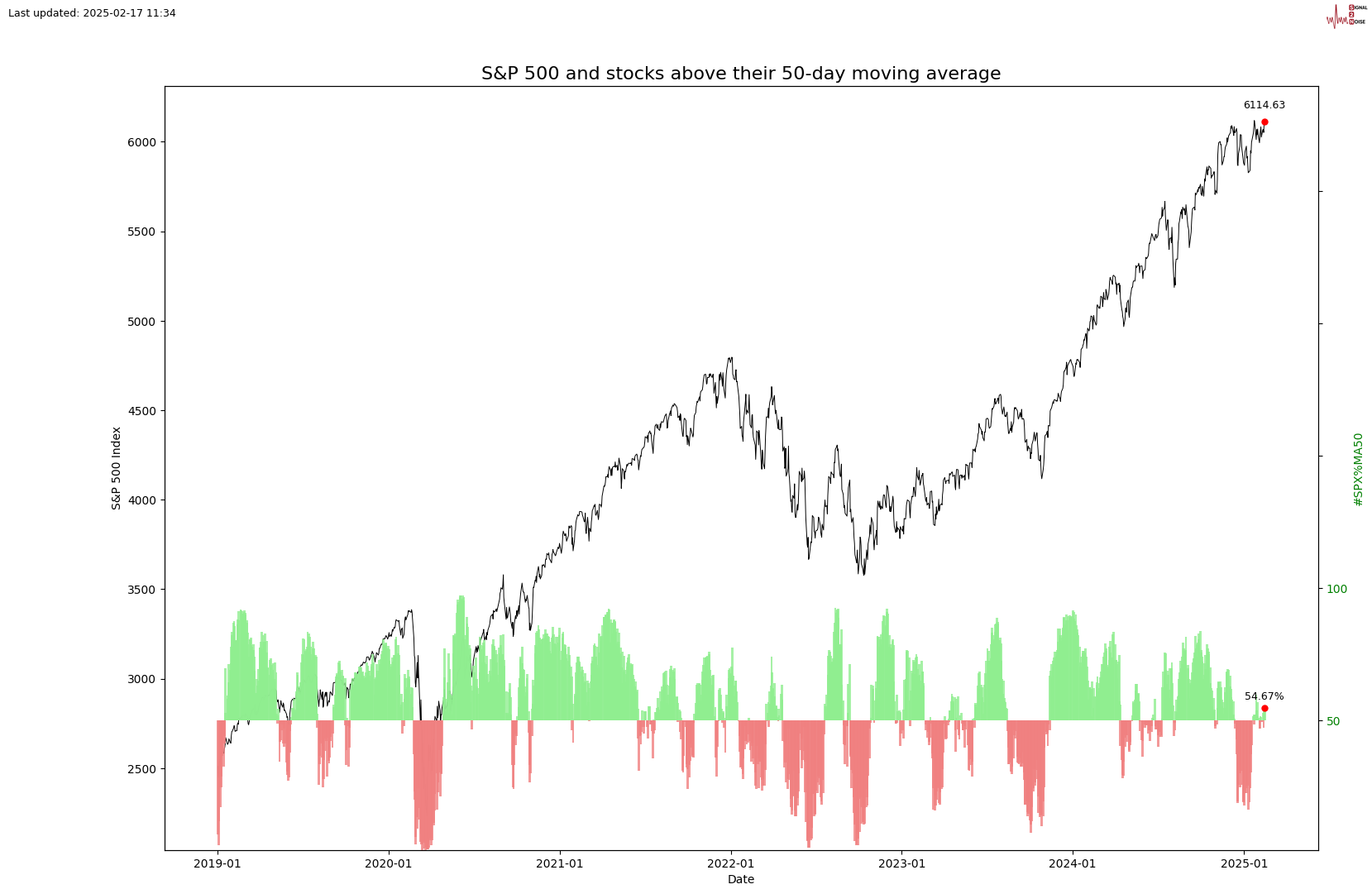

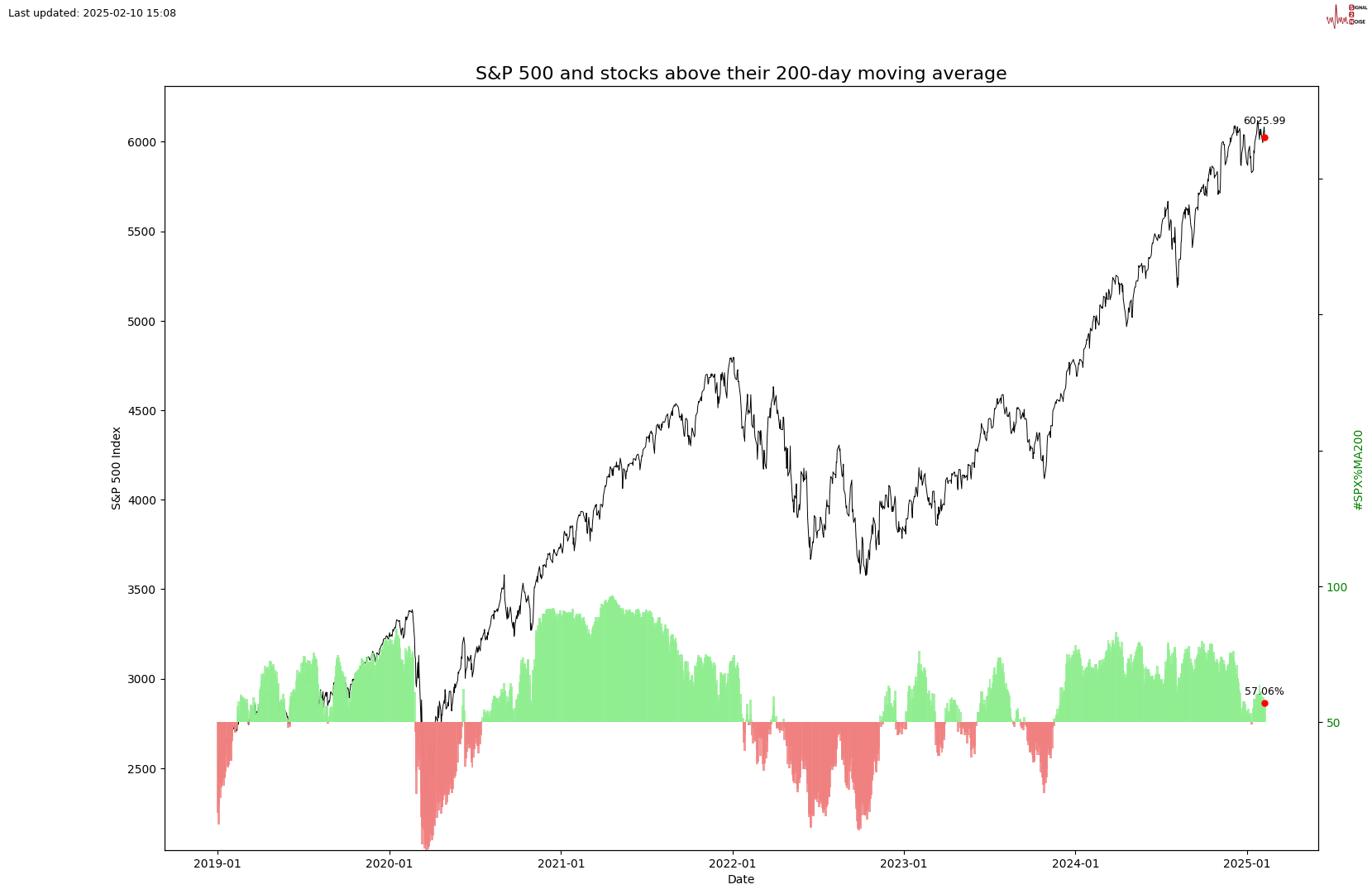

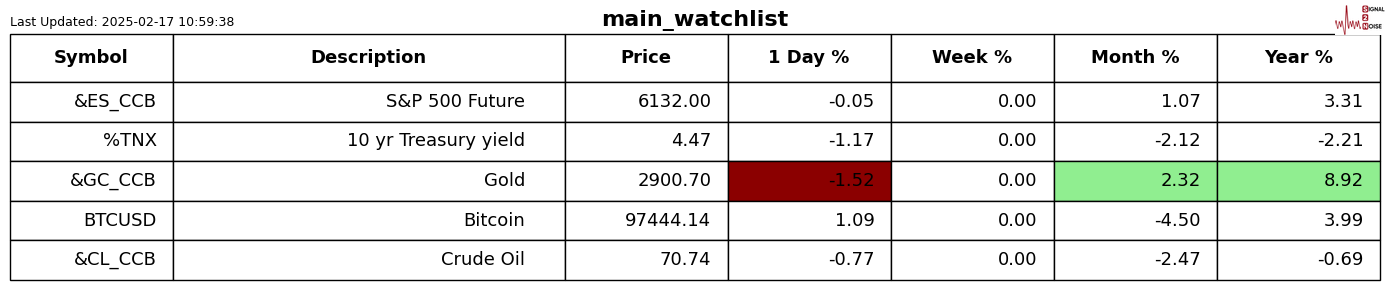

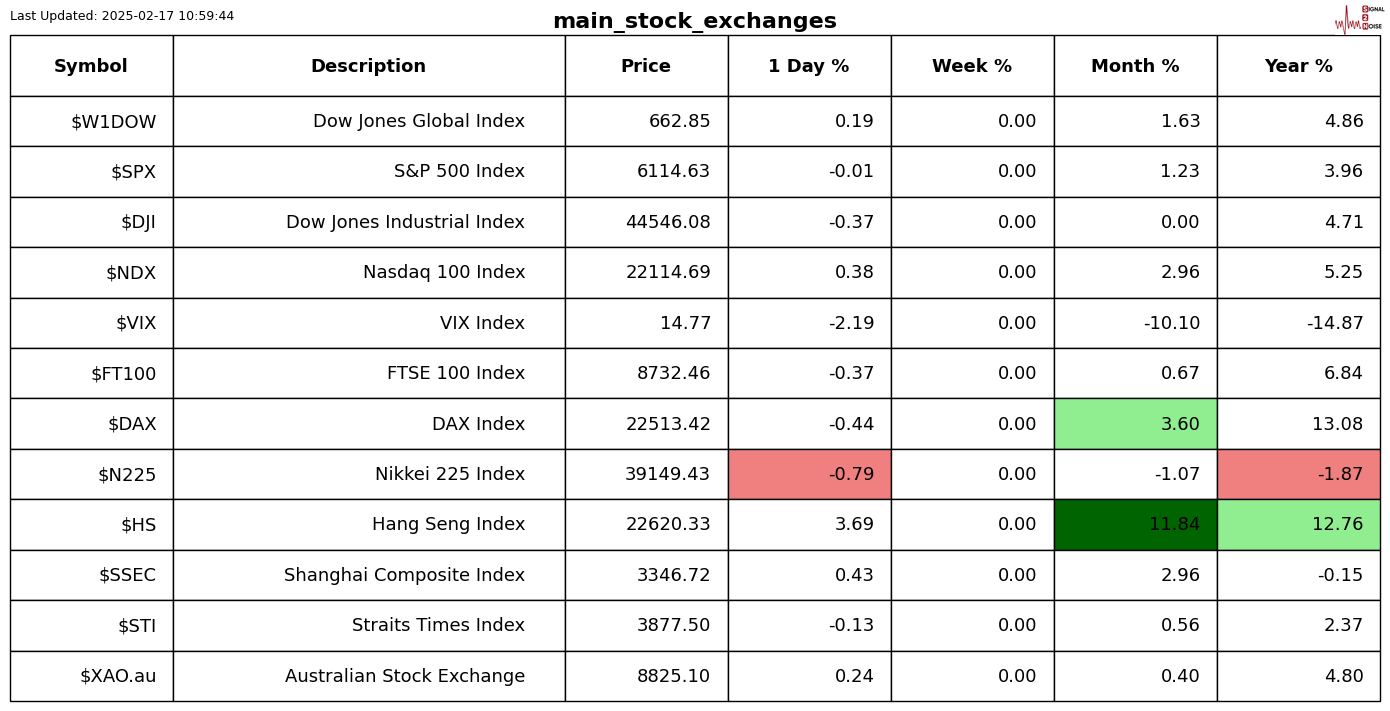

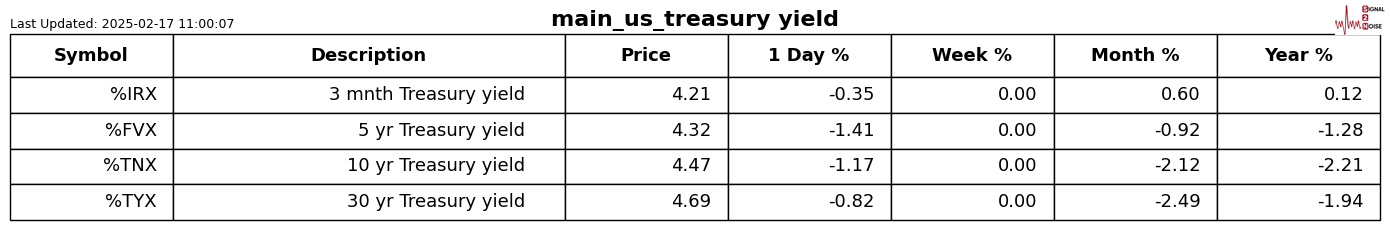

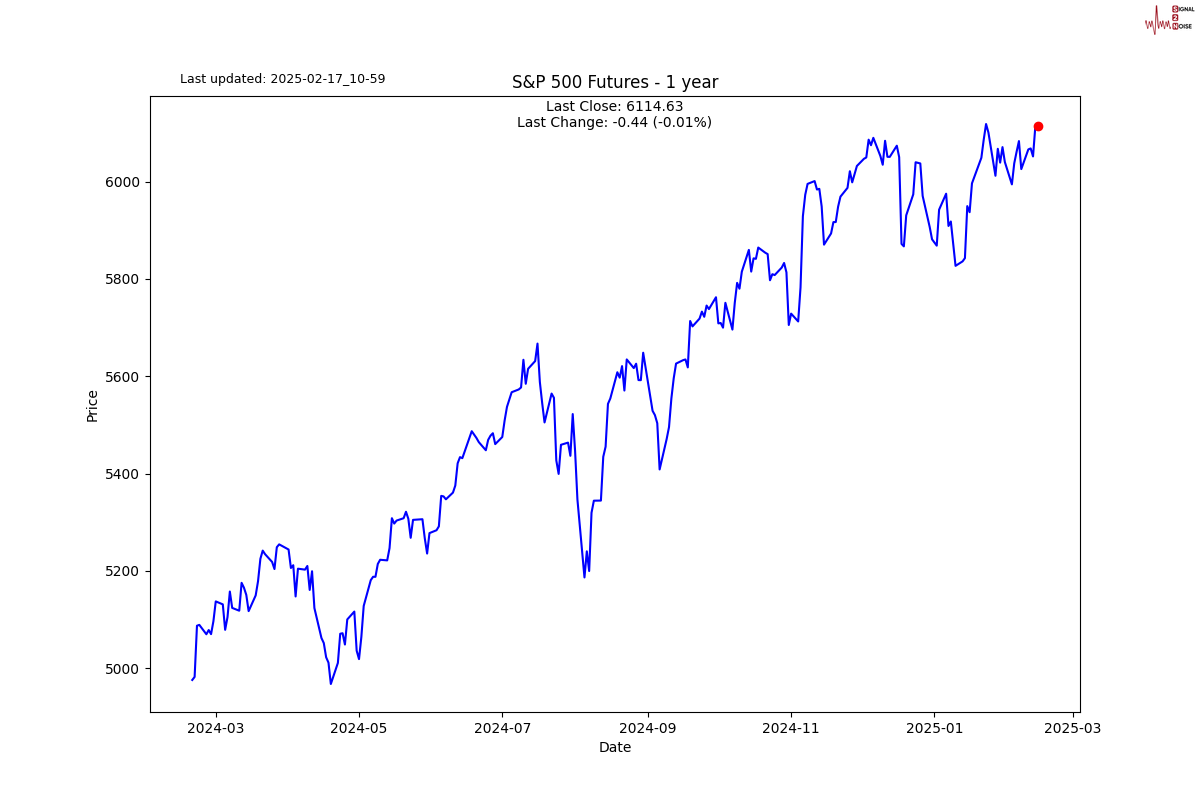

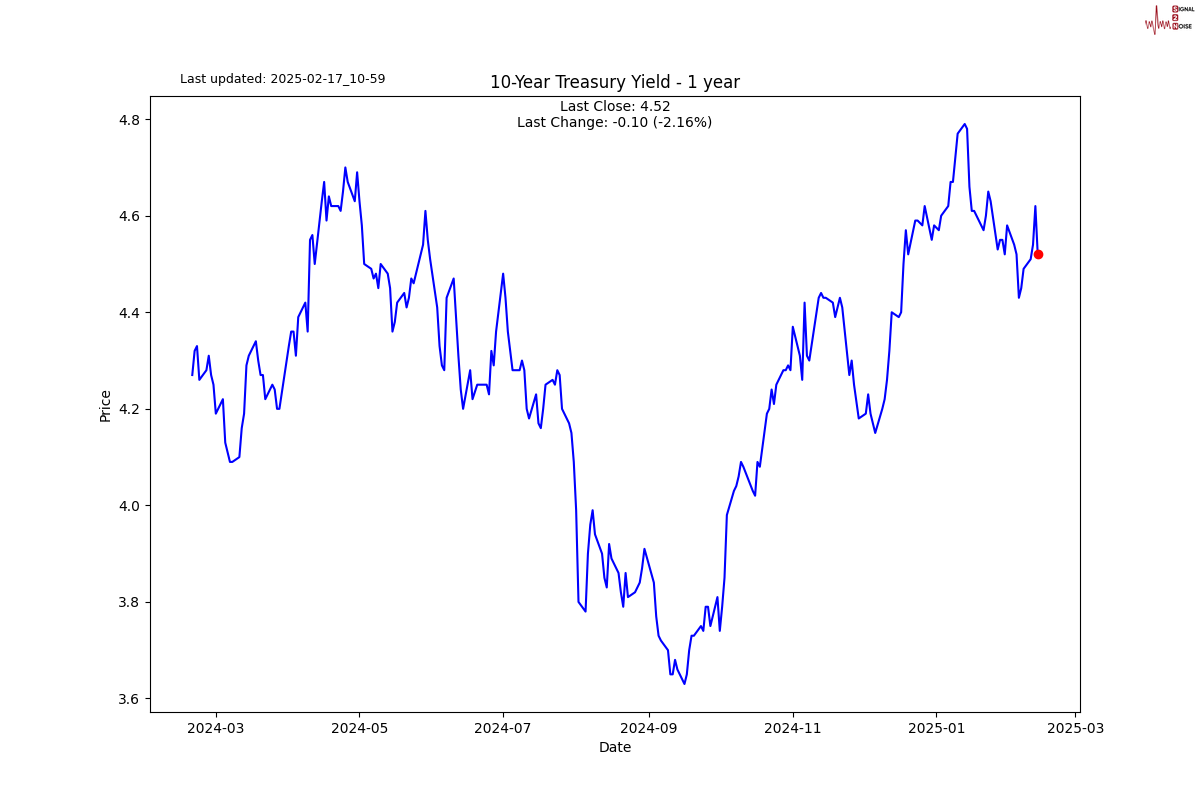

I said on a number of occasions that I think S&P 500 will end the year below as the year started. We are close to the highest level ever. As you can see below, the market is still positive, as there are more than 50 % of companies in S&P 500 higher than average for 50 days and 200 days. We are likely to see some of the upward trend during the week. American markets are closed today.

S2N Screen Alerts

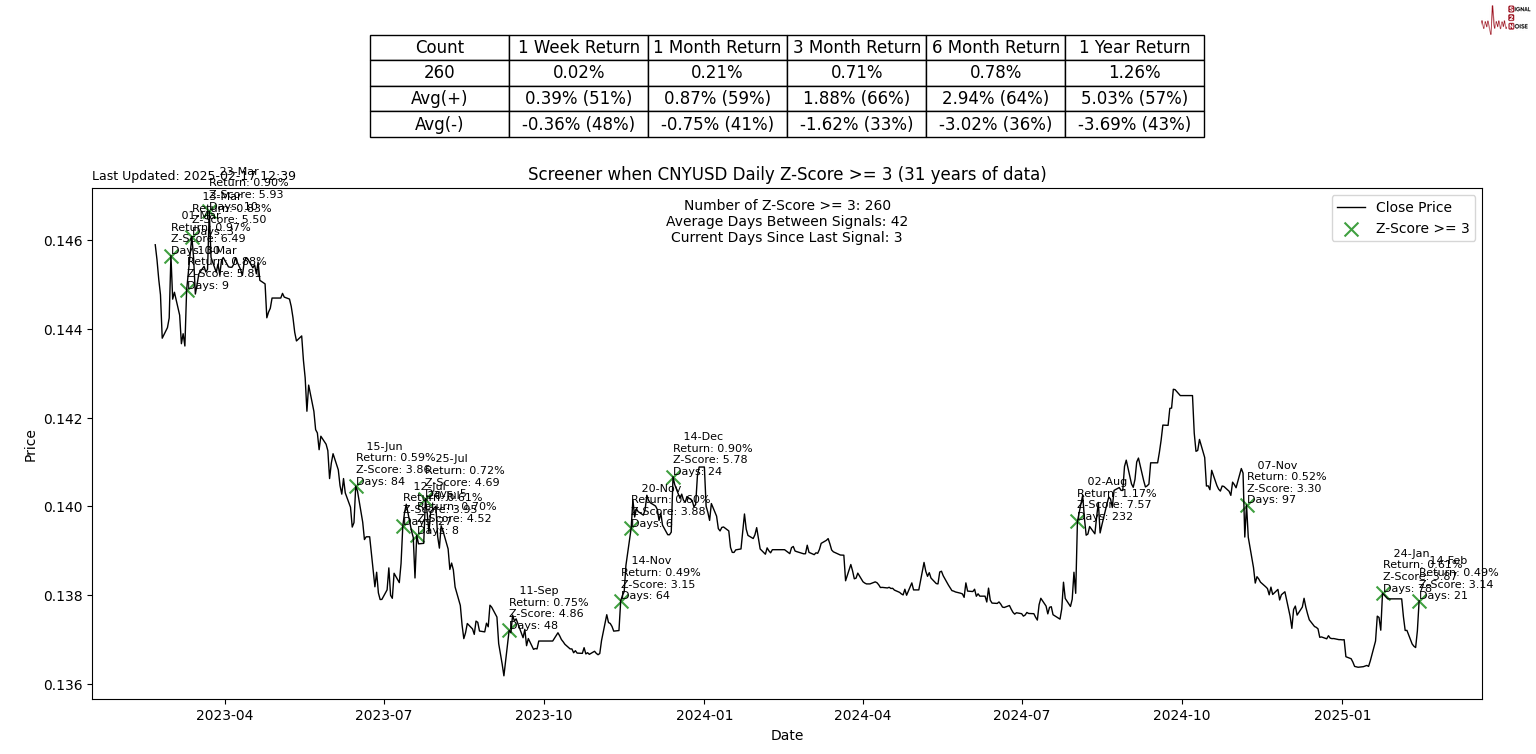

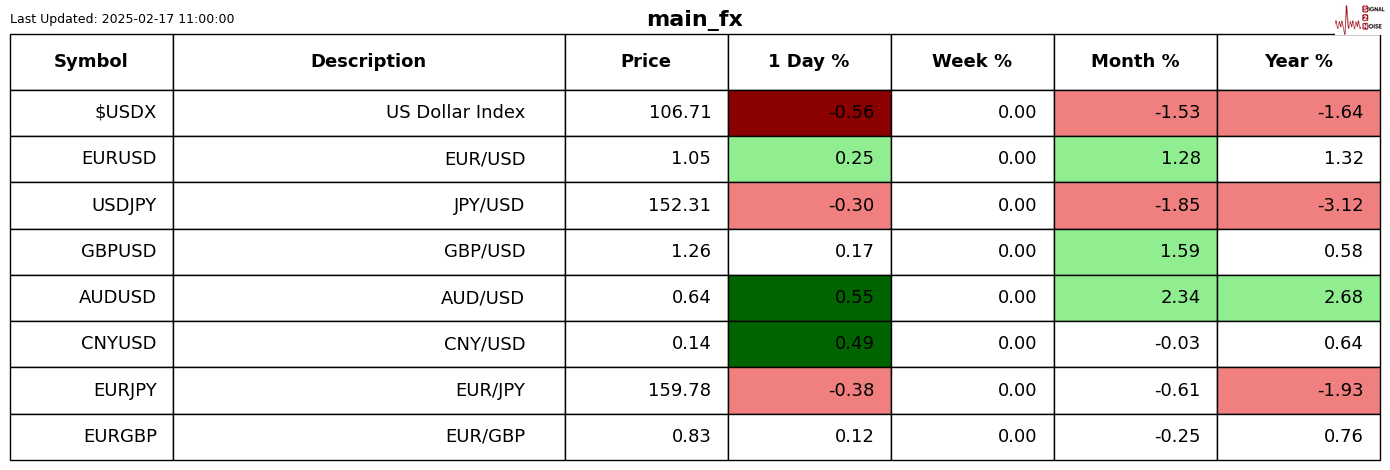

Chinese Renminbi has a rare 3-Sigma Day on Friday. The return may be only 0.49 %, but the degree of Z tells us that this is a rare occurrence given its 31 -year -old date. Tarify wars have quickly become currency wars.

Performance review

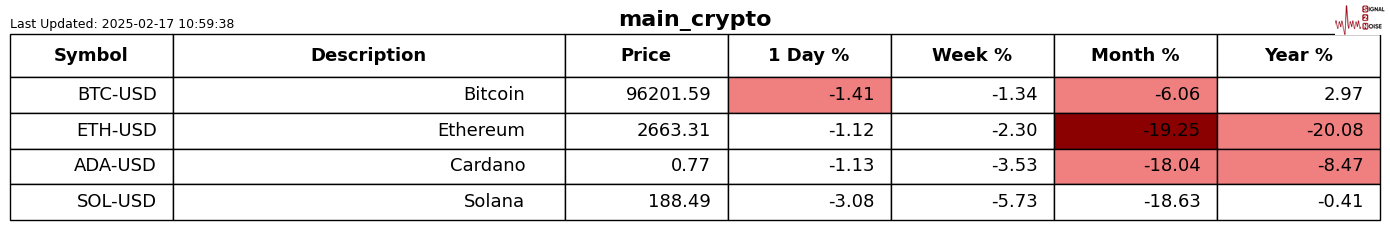

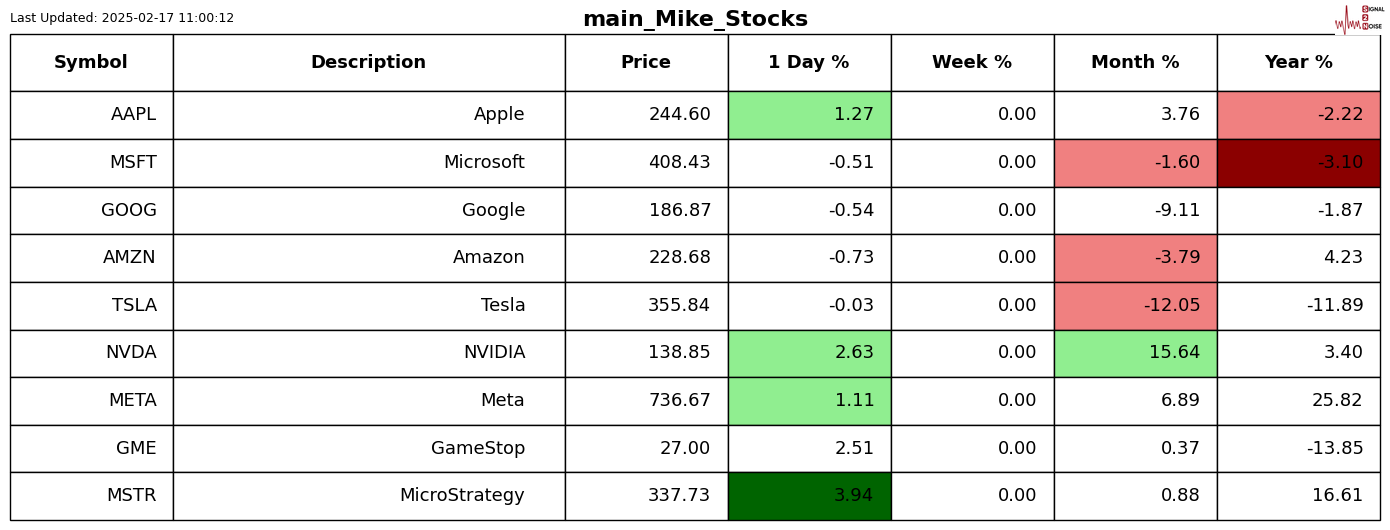

For those new in the message, the Z shading is adjusted until only the move is distinguished than the usual code.

Graphic Gallery

News today

2025-02-17 05:26:12

https://editorial.fxsstatic.com/images/i/Equity-Index_S&P500-2_Large.jpg